Wednesday, June 30, 2010

Buying the dips

It appears that wave c of B is finished. Wave C could be really sharp and violent. Also note the flag pattern, if this breaks to the upside we'll have confirmation of higher prices to come.

Tuesday, June 29, 2010

Working the B?

After rejecting the 61.8% fib resistance again price finally went lower. The internal structure is unclear at the moment, but this should be a wave c of B or 3 of v. The alternate count counts the first wave as corrective not impulsive like i orginally thought (see post earlier this month) with a small wave c of A. Below 1.2208 invalidates the alternate count.

Friday, June 25, 2010

US Dollar - Swiss Frank update

Thursday, June 24, 2010

So many choices

There are different ways to count the decline, but with the small decline out of the triangle i think this is a wave 5 rather then a small wave c. The following rally could be complete or could need one more wave higher. On the bigger timeframe, with the decline probably being impulsive, it is possible that the high (1.2485) is the end of wave IV of 3 or wave A and the impulsive wave is wave "a" of a zigzag (5-3-5)

Wednesday, June 23, 2010

In the middle of the middle

Tuesday, June 22, 2010

Wave B down

Monday, June 21, 2010

Another top...

This is the problem with corrections, there can always be more 3-wave parts. I'm now looking at this triple three correction (w-x-y-x-z). There's always a possibility for another 3 waves to follow, so if you want to try a short, keep your risk small and tight.

Tuesday, June 15, 2010

Is this the top?

Let's make some Moolah

Monday, June 14, 2010

Friday, June 11, 2010

Correction

We're at the point of invalidating the count. The size in both price and time was becoming way too big for a wave iv compared to the size of wave ii. So i'm now counting it as 5 waves down completed.

On the bigger timeframe, this puts us in either wave iv of 3, or in wave A of the 3 wave correction up from the bottom.

Wednesday, June 9, 2010

Complexity simplified

The answer was complex

Tuesday, June 8, 2010

The final count down

Monday, June 7, 2010

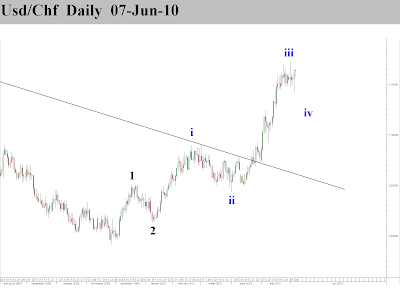

The dollar pension fund

Here's a reason for the alternate count in Eur/Usd. It looks to me that Usd/Chf has bottomed for an extremly long time. This would also mean that stocks have topped for a very long time...

Sunday, June 6, 2010

Small adjustments

Thursday, June 3, 2010

Euro breakout coming?

Tuesday, June 1, 2010

To B(ottom) or not to B(ottom)...

Subscribe to:

Posts (Atom)